Bakkt’s cash-settled BTC futures launch with promising volume

- Amir Razi

- Dec 10, 2019

- 2 min read

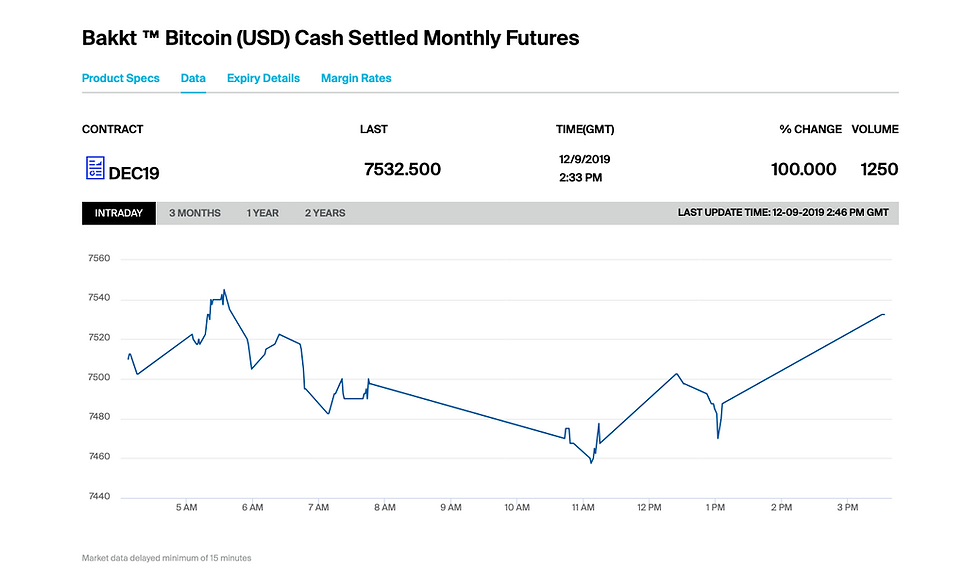

The much-awaited Bitcoin cash-settled monthly futures from Bakkt launched on Dec. 9, recording a volume of 1250 BTC at press time. this is often a pointy contrast to the 72 BTC Bakkt saw listed on its futures debut earlier in September, which suggests that the corporate might be taking up a major part of the market.

Bakkt just launched two new markets

The unsatisfying launch volumes of its futures contracts didn’t stop Bakkt from absorbing the crypto market. With its Bitcoin futures volume up quite 6,200 % since launch, the ICE subsidiary declared the launch of 2 new markets—Bitcoin options and Bitcoin cash-settled monthly futures.

Announced earlier in Nov, the cash-settled BTC futures appeared to clash with the company’s initiation strategy, which was to separate itself from its cash-settled competitors. however, the corporate went on with the launch and also the cash-settled monthly BTC futures launched on Dec. 9.

According to Bakkt’s official announcement, the new cash-settled futures contracts are going to be on the market on ICE Futures Singapore. The regulated exchange can permit customers in Asia and abroad to realize or hedge exposure to bitcoin safely and with efficiency. Contracts can leverage the settlement value of the physically-settled Bakkt monthly futures, the company said.

Bakkt’s Bitcoin options are the primary CFTC regulated option on futures contracts for bitcoin. The contracts also will be supported by Bakkt’s bitcoin monthly futures and settle into the underlying futures contract 2 days before they expire.

Cash-settled BTC futures first day volumes look promising

Bakkt COO Adam White said:

“These new contracts represent an important milestone in the development of this emerging asset class and our bitcoin product complex.”

White’s statement is in line with the company’s aggressive market takeover, which looks targeted on outmuscling the Chicago Mercantile Exchange (CME). Last month, White proclaimed that the New York-based company had spread out its custody solution to any establishments wanting to store Bitcoin.

According to Bakkt’s official web site, the cash-settled monthly futures saw a volume of 1250 BTC at 2:30 pm gmt. With a few more hours left before trading closes, the launch day volumes already look promising.

Comments